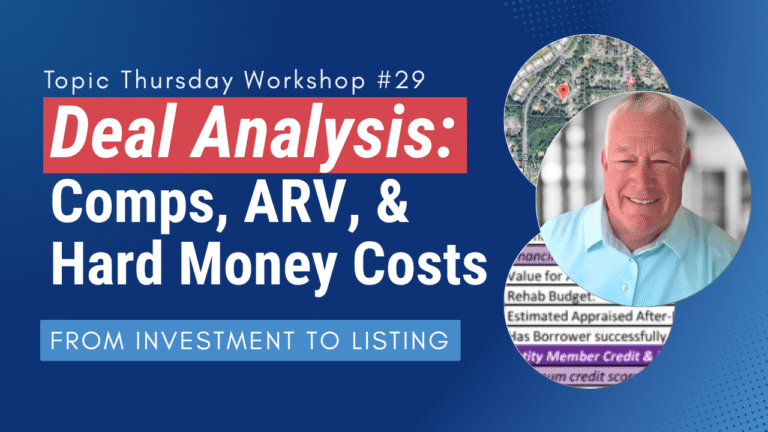

Topic Thursday 29: Home Evaluation and Deal Analysis Walkthrough

This week’s Topic Thursday walks through a real property evaluation — showing how to pull comps, verify ownership, calculate ARV, and understand profit margins from an agent-investor perspective.

Robert uses an active deal to teach how to evaluate homes, structure cash offers, and analyze profits from investment stage to listing.

Replay + Resources

Resources to Explore

Resources to Explore

- Letter Templates & Postcards for This Week’s Homework

Want to join these trainings live? Get certified as an EZ Agent

Want to join these trainings live? Get certified as an EZ Agent ![]() Enroll Now

Enroll Now

Investment System Overview

00:00 Understanding the Four Investment Processes

02:23 Buyer’s Premium and Investor Profit Margins

03:47 Novation vs Fix and Flip: Property Occupancy

Robert explained how every investment deal fits into one of four processes: cash offers, novations, 10% buyer premium listings, or fix-and-flip opportunities. The EZ system helps agents identify which strategy makes sense for each property.

The group also discussed how occupancy can determine whether to pursue a novation or traditional flip — a key detail that shapes how you approach both the seller and your investor partner.

Seller Lead Qualification & Data Verification

04:30 Seller Lead Qualification: Questions to Ask

06:33 Verifying Property Ownership and Tax Records

Before running comps, confirm your data. Robert showed how to verify tax records, ownership, and previous sales history to ensure accuracy. He also shared qualifying questions that help you identify motivation, timeline, and repair expectations early.

Running Comps & Property Analysis

07:27 Running Comps in the MLS

08:56 Analyzing First Comparable Property

09:59 Comparing Kitchen and Interior Features

11:25 Subject Property’s Superior Upgrades

12:42 Evaluating Dated Properties That Sold High

14:04 Reviewing Subject Property Photos

14:41 Determining Property Value After Repairs

16:04 $250K in Recent Renovations Explained

Robert compared active, pending, and sold listings to determine true market value. The subject property — renovated with $250K in updates — outperformed nearby sales, supporting a projected ARV of $1.35M.

Agents learned how to quickly spot upgrades that matter most in valuation: kitchens, flooring, and presentation.

Offer Strategy & Deal Details

16:43 Team Estimates: What Should We Offer?

16:59 Purchase Price Revealed: $850K

17:18 Excise Tax in the Deal

17:53 Reviewing the Purchase Sale Agreement

Agents walked through offer pricing, factoring in excise taxes, fees, and profit spread. The final offer came in at $850K — right in line with the 70% minus repair cost formula used by professional investors.

Financing, Costs & Profit

18:59 Comparing Three Hard Money Lenders

19:33 Best Loan Terms: 9% Interest, 1.25 Points

20:22 Breaking Down the Costs & Cash Required

21:12 How Contractor Relationships Work

22:08 Projected Net Profit: $211K Minimum

Robert broke down real loan terms and fees from three lenders. The chosen loan carried 9% interest and 1.25 points, producing a minimum $211K profit after expenses.

He also discussed how reliable contractor relationships protect both investor margins and agent credibility.

Financing Options & Strategy

23:01 Financing Options for Investors with No Money Down

24:30 Why the Seller Rejected the Novation Offer

25:04 The 70% Minus Repair Cost Formula

26:03 Total Profit Including Commission Breakdown

26:56 Can You Refinance Existing Hard Money Loans?

The team reviewed the “no money down” options available to investors and why understanding cost breakdowns builds trust. Robert shared how commissions fit into total profit and how agents can keep deals fair and transparent.

Agent Advantage & Market Shift

29:41 How These Programs Increase Your Value to Investors

30:57 Preparing for the Shift to Seller’s Market

Understanding ARV, repair costs, and profit structures positions agents as true advisors — not just listing reps.

Robert closed this section with reminders that a seller’s market is coming, and agents who master these calculations will stand out to both homeowners and investors.

Tools, Forms & Homework

31:47 Accessing the Document Library and Forms

32:20 Schedule Updates and Homework Reminder

Agents received homework: practice running comps, evaluate a property using the 70% rule, and prepare to discuss investor outreach.

Robert also shared where to find templates, purchase-sale forms, and investor documents inside the EZ Agent Hub.

💡 Bonus Resources for Homework & Marketing

If you’re building your agent-investor pipeline, these tools will save you time and make outreach easier:

30+ Real Estate Letter Templates Pack – ready-to-send letters for FSBOs, cancellations, and neighborhoods.

Daylight Savings Postcard Template – a seasonal postcard featuring your 0% listing USP.

Never Pay a Commission Flyer & Sign Pack – great for open houses or farming drops.

EZ Seller Ads and Canva Templates – customizable Canva designs to reuse for mailers or ads.

💡 Quick Tip: Turn Canva Ads into Postcards

1️⃣ Resize your Canva project to postcard dimensions

2️⃣ Add a second page for the postcard back

3️⃣ Export both pages for double-sided printing

What’s Next? Get Connected and Keep Learning!

Communities to Join:

Private Student Facebook Group: Join Here

Public EZ Community: Join Here

EZ REI Club: Join Here

Not an EZ Agent?

Become an EZ Agent – If you’re committed to learning, we can waive your enrollment fee.